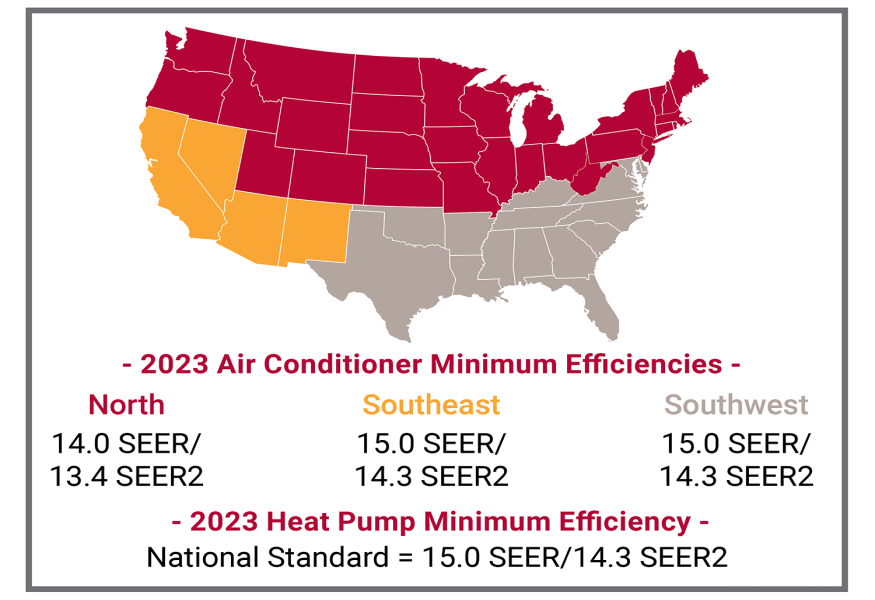

Seer stands for seasonal energy efficiency ratio commonly referred to incorrectly as seasonal energy efficiency rating a seer rating is the ratio of the cooling output of an air conditioner over a typical cooling season divided by the energy it consumed in watt hours.

Air conditioner seer rating tax credit.

Hvac air circulating fan.

Gas propane or oil hot water boiler.

To verify tax credit eligibility ask your hvac contractor to provide the manufacturer certification statement for the equipment you plan to purchase.

Air conditioners and air conditioner coils and select yes for eligible for federal tax.

With seer 16 and eer 13 or package systems with seer 14 and eer 12.

300 credit for stoves with an efficiency of 75.

Air conditioners recognized as energy star most efficient meet the requirements for this tax credit.

Eer 13 and seer 16 package system.

Air source heat pumps.

150 with afue 95.

Eer 12 and seer 14.

The criteria for qualifying for that tax credit is that the system must meet certain energy efficiency guidelines.

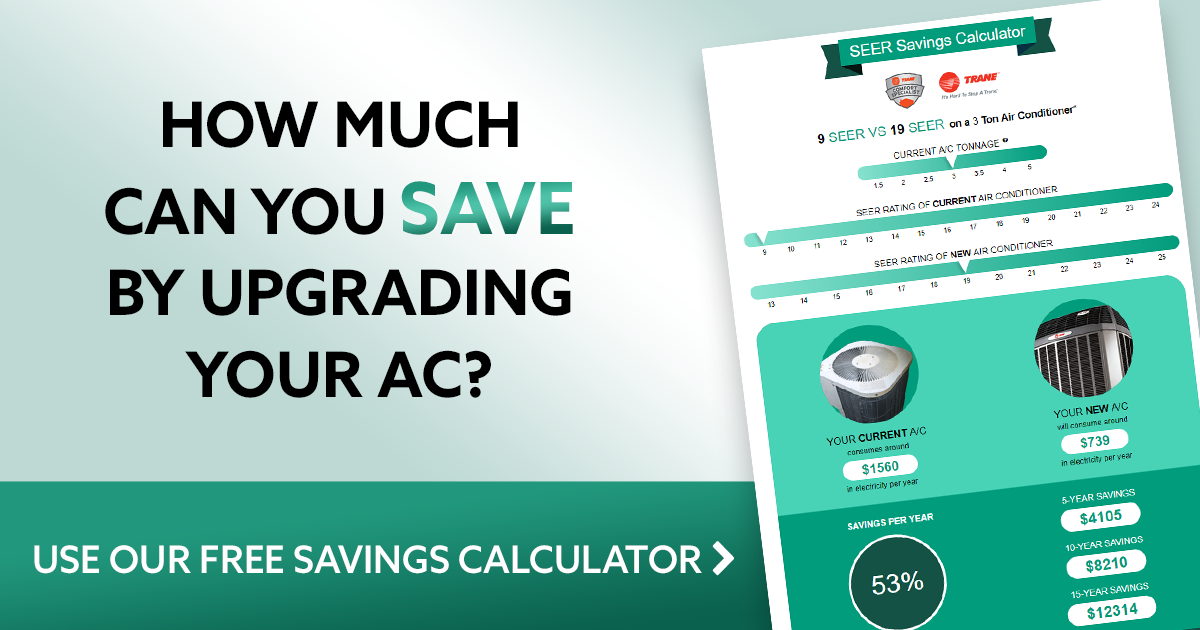

So making smart decisions about your home s heating ventilating and air conditioning hvac system can have a big effect on your utility bills and your comfort.

Seer 16 eer 13.

300 for split systems.

Having the opportunity to claim a tax credit on your taxes when you install a qualifying air conditioning system is a great way to reduce the cost of this large investment.

Hspf 8 5 eer 12 5.

Packaged systems must have a seer seasonal energy efficiency ratio of greater than or.

They must meet the following criteria.

Qualifying air conditioning systems.

Matched with a correct indoor coil and or furnace to achieve the energy efficiency criteria required to qualify for the tax credit.

A cooling efficiency of greater than or equal to 15 seer 12 5 eer or higher and a heating.

Seer 14 eer 12.

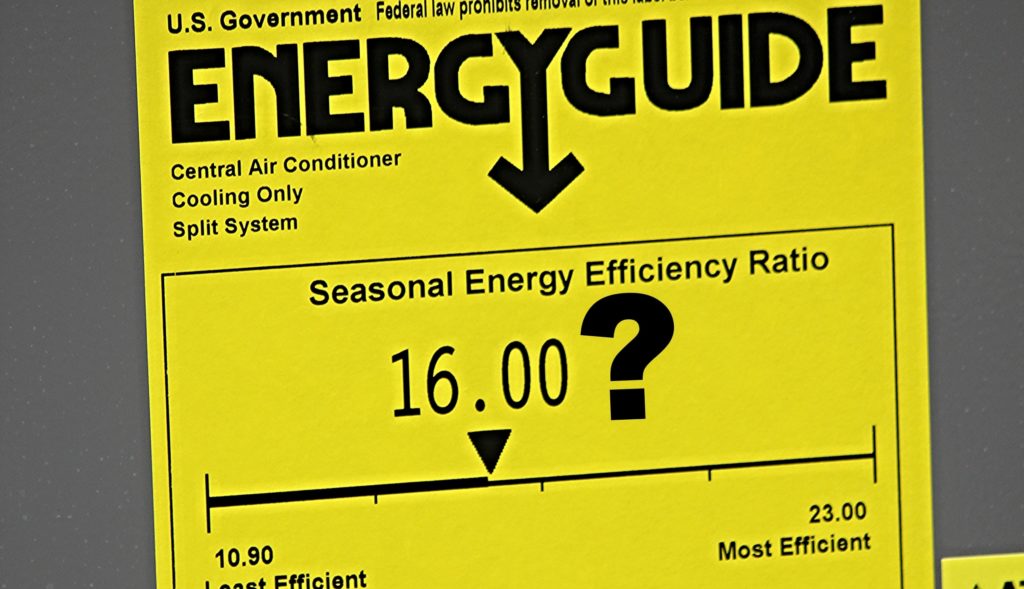

Split system air conditioning must meet 25c requirements of 16 seer 13 eer both efficiency levels must be met to qualify for the tax credit manufacturer s certificate split system heat pump must meet 25c requirements of 15 seer 12 5 eer 8 5 hspf all three efficiency levels must be met to qualify for the tax credit manufacturer s certificate.

300 requirements split systems.

In order to receive a tax credit of 300 the air conditioning system must meet the following criteria.

The tax credit is for 300.

50 for fans that use less than 2 of a furnaces energy.

A cooling efficiency of greater than or equal to 14 seer and 12 eer.

Heating ventilating air conditioning hvac as much as half of the energy used in your home goes to heating and cooling.

Split systems must have a seer seasonal energy efficiency ratio of greater than or equal to 16 and an eer energy efficiency ratio of greater than or equal to 13.